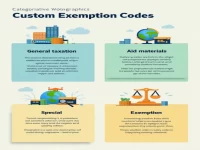

Goldplated Scrap Market Gains Traction Amid Tax Incentives

This article delves into the HS code 7112911090 for gold-containing scrap and its associated tax rates, highlighting the importance of resource recovery and market potential. It provides detailed declaration elements and regulatory conditions to help enterprises seize business opportunities more effectively.